Eligible Fsa Expenses 2025

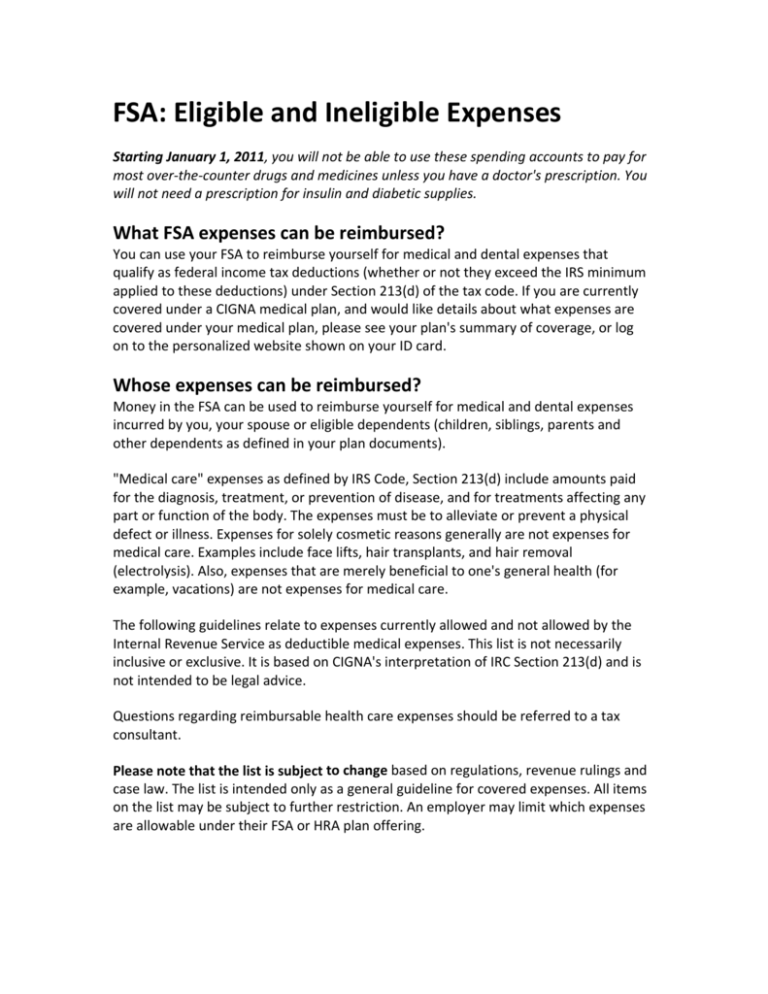

Eligible Fsa Expenses 2025. You need to use fsa funds by the end of the plan year, unless your employer has a carryover option or a grace. An employee who chooses to participate in an fsa can contribute up to $3,300 through payroll deductions during the 2025 plan year.

For 2025, the fsa contribution limit is going up to $3,300. Eligible employees of companies that offer a health flexible spending arrangement (fsa) need to act before their medical plan year begins to take advantage of an fsa during 2025.

Eligible Fsa Expenses 2025 Images References :

Source: callabjocelyn.pages.dev

Source: callabjocelyn.pages.dev

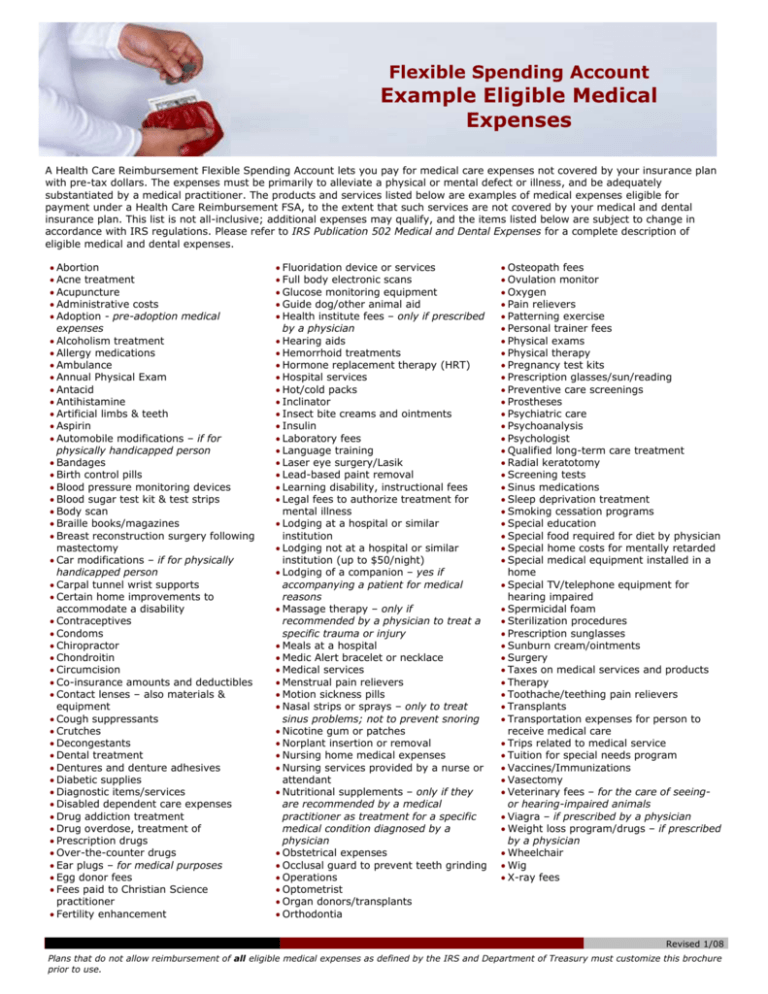

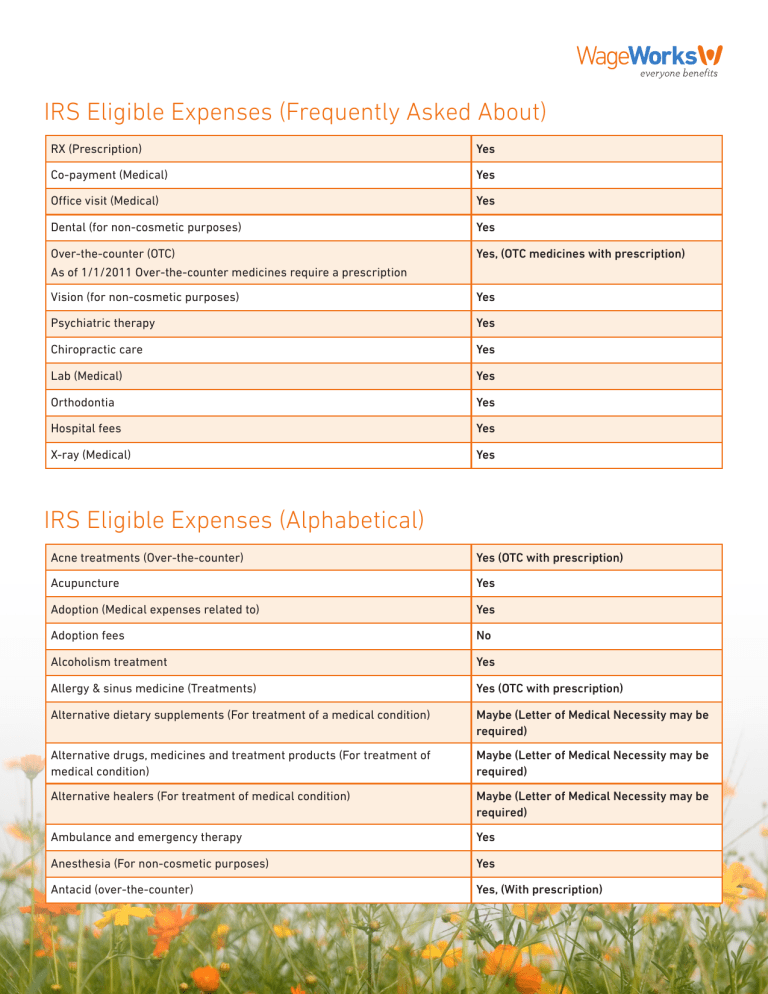

Fsa List Of Eligible Expenses 2025 Zia Xaviera, Here’s what you need to know.

Source: callabjocelyn.pages.dev

Source: callabjocelyn.pages.dev

Fsa List Of Eligible Expenses 2025 Zia Xaviera, Plan ahead for recurring medical.

Source: natkabsileas.pages.dev

Source: natkabsileas.pages.dev

Irs Fsa Eligible Expenses 2025 List Emilia Aindrea, Read on to learn about qualifying expenses, 2025 fsa contribution limits, and more.

Source: mayeqandreana.pages.dev

Source: mayeqandreana.pages.dev

2025 Fsa Limit Elly Noelle, Learn how they work, contribution limits, and the.

Source: natkabsileas.pages.dev

Source: natkabsileas.pages.dev

Irs Fsa Eligible Expenses 2025 List Emilia Aindrea, Fsa funds can be used to cover a wide range of approved healthcare services and products.

Source: cheriebkaitlin.pages.dev

Source: cheriebkaitlin.pages.dev

Can I Use 2025 Fsa For 2025 Expenses Lucky Roberta, If your adjusted gross income is $15,000 or less, the credit can be worth 35% of eligible expenses;

Source: amberbkatusha.pages.dev

Source: amberbkatusha.pages.dev

Fsa Eligible Expenses 2025 List Haily Kellsie, The federal flexible spending account program.

Source: amberbkatusha.pages.dev

Source: amberbkatusha.pages.dev

Fsa Eligible Expenses 2025 List Haily Kellsie, Find out what healthcare costs are covered as fsa eligible expenses.

Source: amberbkatusha.pages.dev

Source: amberbkatusha.pages.dev

Fsa Eligible Expenses 2025 List Haily Kellsie, (see our list of qualifying hsa.

Source: charlesmcdonald.pages.dev

Source: charlesmcdonald.pages.dev

Fsa Eligible Items 2025 Listing Charles Mcdonald, Understanding these changes now can help you make.